Sustainable Finance

We often hear about sustainable finance and come across the term green investment, but few have a broad understanding of the sector and the role of banks in supporting it. In this report, Aldanah Altamimi and Noura take you on a journey to understand the sector more deeply, specifically through the framework of sustainable finance at Al Rajhi Bank.

Sustainable finance is an investment approach that balances financial returns with a positive impact on the environment and society by directing investments toward sustainable projects, such as renewable energy and green infrastructure.

In Saudi Arabia, sustainable finance is witnessing notable growth. In 2024, the Ministry of Finance launched the “Green Finance Framework,” and the Saudi Green Initiative aims to reduce emissions by 278 million tons annually by 2030. Despite a 22% global decline in sustainable finance, the negative impact has been reduced locally due to clean energy investments.

Sustainable finance goals for organizations:

1. Financial independence: Covering costs without relying on donors.

2. Income diversification: Reducing risks through multiple sources.

3. Generating financial surplus: To support future activities.

4. Improving financial management: Efficiency and transparency.

5. Financial planning: Clear strategies.

6. Enhancing institutional capabilities.

Factors influencing sustainable finance in Saudi Arabia:

1. Government regulations

2. Community awareness

3. Technological advancements

4. Global demand for sustainability

5. Economic conditions

6. Climate change

But who is leading this sector in the Kingdom? Al Rajhi Bank... A strong footprint in sustainable finance!

How does Al Rajhi apply sustainable finance?

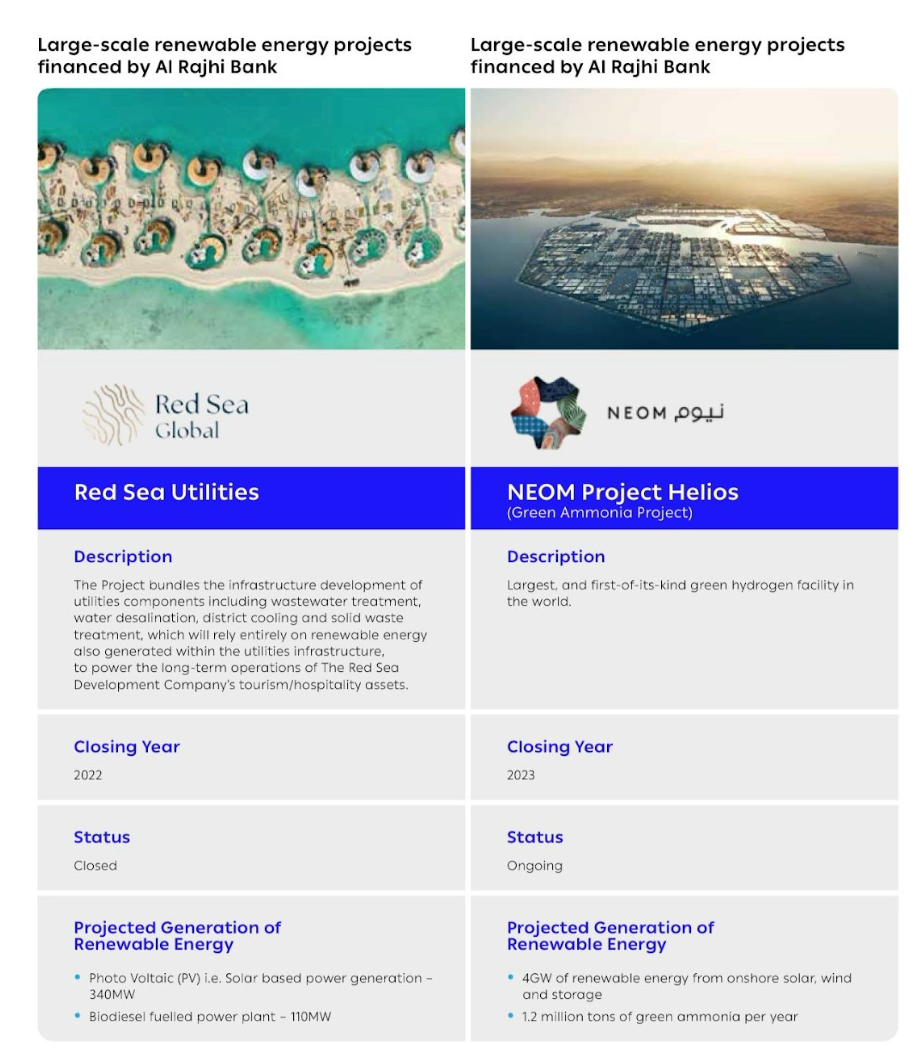

The bank has set a framework that defines how to issue sustainable bonds, sukuk, and loans, with proceeds allocated to projects that meet environmental and social standards. This includes financing major projects like Neom and the Red Sea, reinforcing its commitment to the green transition.

Al Rajhi follows green and social bond standards, supporting major projects like Neom and the Red Sea, further enhancing its commitment to transitioning to a green and sustainable economy.

Al Rajhi Tower is a living example of sustainable finance, as it relies on technologies that reduce energy consumption and uses eco-friendly materials, reflecting the bank's commitment to environmental standards.

By 2030, the bank continued to apply ESG standards to enhance transparency and reduce its carbon footprint, while also committing to financing projects that support the green economy. Its efforts reflect its role in achieving sustainable development in line with Saudi Vision 2030.

Sustainable finance in Saudi Arabia is witnessing strong competition among banks to support Vision 2030!

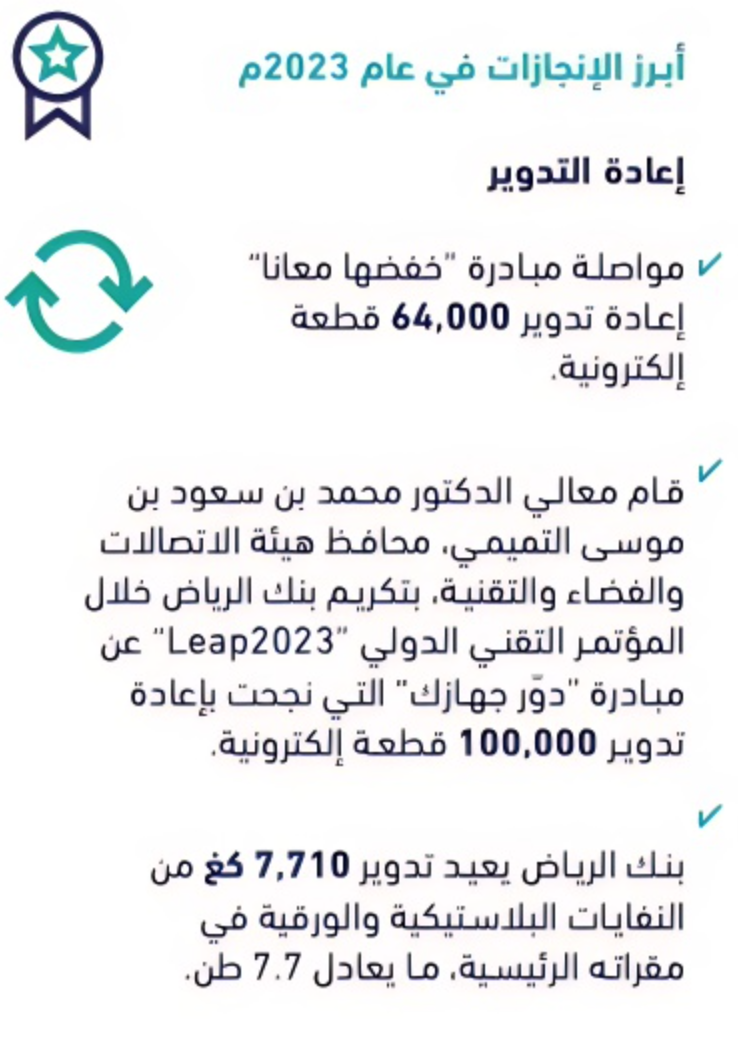

With an increasing focus on sustainability, banks are racing to offer green financing solutions. Leading the way are Riyad Bank and SABB, which provide advanced strategies including green bonds and renewable energy financing.

Riyad Bank and sustainable finance

In February 2025, Riyad Bank joined the United Nations Global Compact, becoming one of the first Saudi banks to participate, reflecting its commitment to sustainability and social responsibility. Additionally, in 2024, it launched a comprehensive strategy to support sustainable projects.

📢SABB Bank and financial sustainability

In 2024, SABB Bank received the "Best Bank for Sustainable Infrastructure Financing in the Middle East" award from Global Finance magazine, in recognition of its efforts in supporting sustainable infrastructure projects. The bank also adopted sustainable banking cards made from recycled plastic.

The future of financial sustainability for non-profit organizations depends on diversifying income sources, such as local funding, partnerships, and commercial initiatives. It also requires innovating new fundraising models and leveraging technology and social media to enhance resources and attract donors.

The evolution of financial sustainability includes improving strategic planning, developing institutional capacities, and raising community awareness to support sustainability. Organizations are also increasingly focusing on strengthening partnerships with both the public and private sectors to ensure sustainable funding and adapt to economic changes.

Sources

https://www.ndmc.gov.sa/mediacenter/news

https://www.vision2030.gov.sa/ar/explore/

https://www.forbesmiddleeast.com/ar/